- CALL:(+852) 3622 1101

- Enquiry: (+852) 3622 1101

- Support: (+852) 6495 2686

SN KYC Total Screening Compliance System

Using innovative technology to provide the financial industry and professional fields with the best compliance solutions for anti-money laundering and risk assessment when conducting customer due diligence.

What is SN KYC Total Screening?

SN KYC Total Screening is an intelligent screening system that integrates machine learning, analysis, and big data to provide you with a due diligence solution when fighting criminals and terrorists' money laundering activities. The system provides flexibility and simplify the review process for monitoring Anti-Money Laundering (AML) and Counter Terrorist Financing (CFT) activities, as well as perform detailed screening analysis and continuous monitoring of Politically Exposed Persons (PEPs), high risk individuals and entities.

Skynet also customizes exclusive AI functions and data analysis for professionals and the financial industry to comply with the "Guideline on Compliance of Anti-Money Laundering and Counter-Terrorist Financing Requirements” stipulated by the Government Authorities

Professional Features

The system provides flexibility and simplifies the compliance review process when monitoring Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) activities, as well as detailed screening of Politically Exposed Persons (PEPs), high-risk individuals and entities Analysis and continuous monitoring.

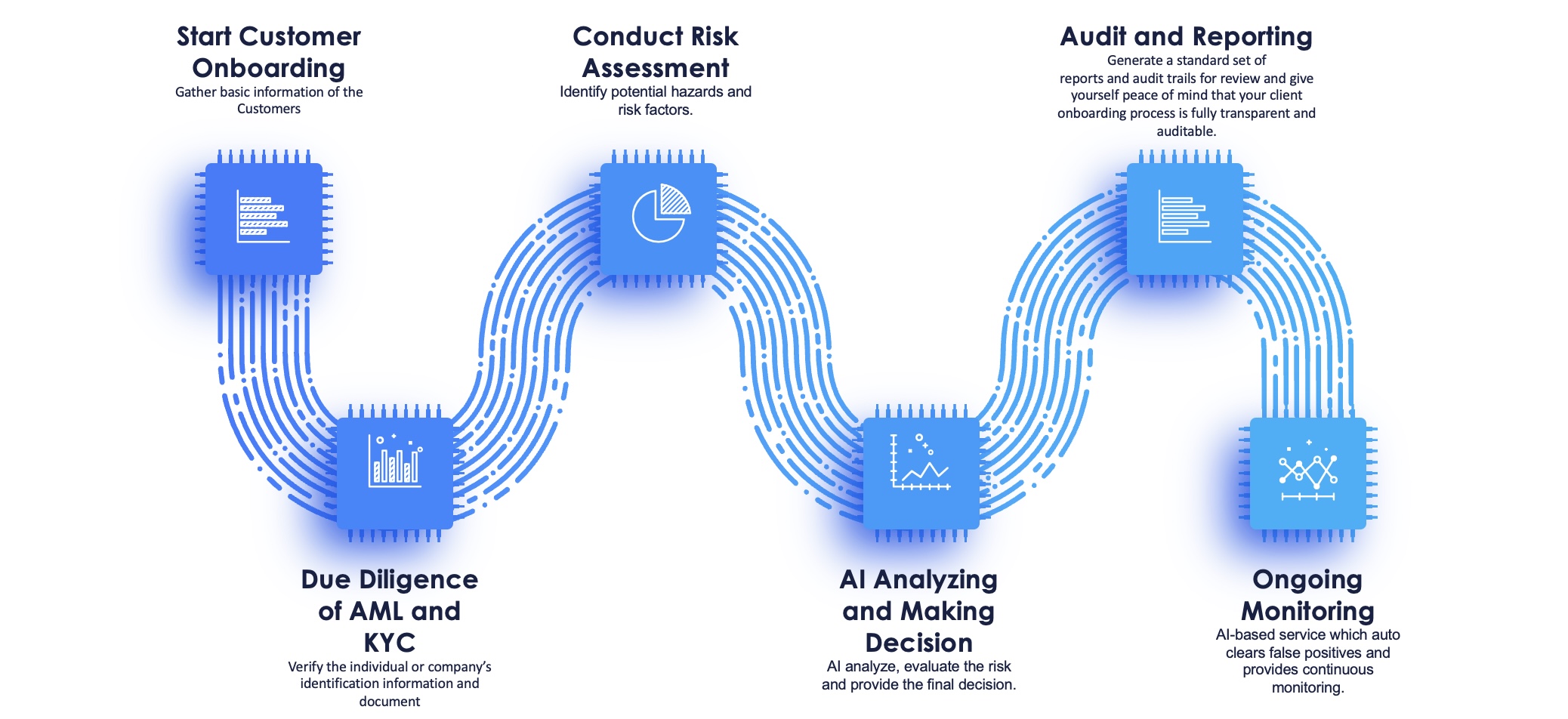

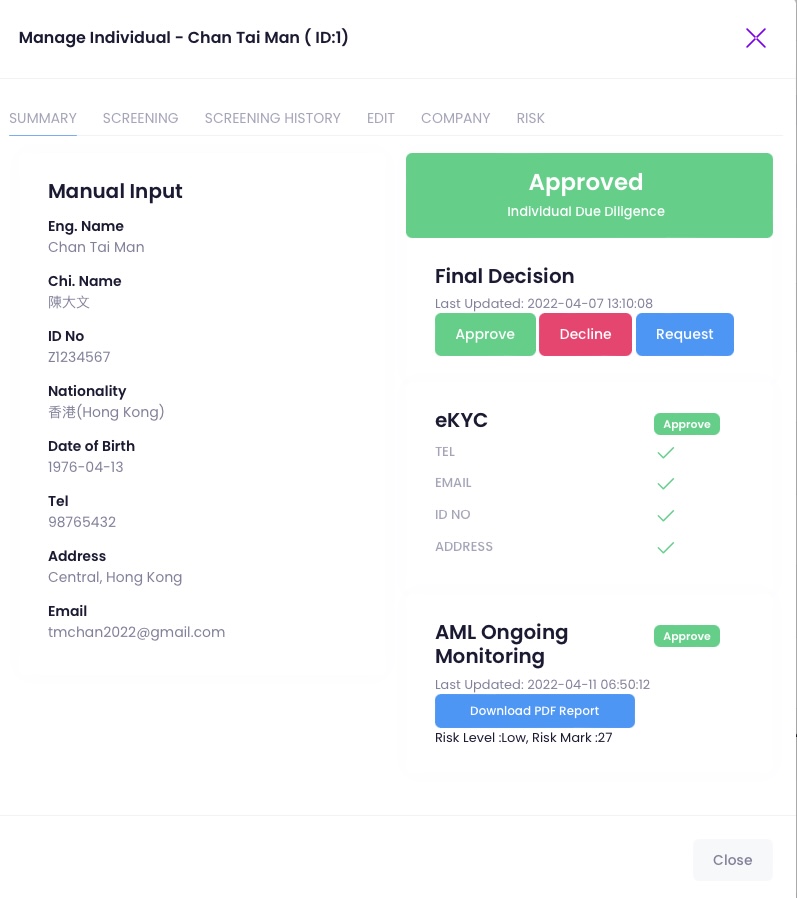

Customers Due Diligence for AML/CFT

Leverage our API technology to integrate big data information, matching capabilities, and advanced features into existing workflows, streamlining customer onboarding, know-your-customer (KYC), and due diligence processes with flexible information tools.

SN Big Data Database

Smarter recommendations and targeting

Cloud Based

Cloud Based Database 24hours running with low latency, high elasticity, high stability and redundancy.

Data Encryption

All data are securely stored in Cloud Server with data encryption technology.

Daily Update

Daily update of global data.

SN Watchlist Collections

Our big data database has been rigorously screened, analyzed and integrated, and the list of individuals and entities from all over the world is aggregated and updated daily. It includes more than 70 international sanctions lists (including the United Nations, OFAC, etc.), international crime and most wanted lists, global multinational politically exposed person lists, etc.

The following is our four main collections:

SN Due Diligence List

Skynet's unique due diligence series list integrates individual and entity lists from more than 200 countries around the world to obtain more reliable and accurate results when performing due diligence.

Global Sanctions Watchlist

List of individuals and entities subject to comprehensive or targeted restrictions under international and domestic sanctions regimes, including more than 70 watchlists including UN Security Council Sanctions List, US OFAC Sanctions List, EU Sanctions List, etc., in line with the regulations of the Hong Kong government Guidelines on Anti-Money Laundering and Terrorist Financing Regulations.

Politically Exposed Persons (PEPs), their relatives and close associates

The company's research team collects political and public figures (PEPs) with social influence and exposure from more than 200 countries and regions around the world, their family members and close relationships, to enrich the database.

Warrants and Criminal Entities

Companies and people implicated in or convicted of criminal activites, including the "Most Wanted" lists of various countries and international authorities.

SN IQ Intelligent Risk Analysis

Skynet's unique AI intelligent screening and analysis system (SN IQ for short) improves the efficiency and accuracy of due diligence and reduces the company's operational risks through powerful intelligent search, analysis and machine learning technologies.

We are based on technologies and innovation

Using AI and Machine Learning to build a service. Speed up customers onboarding and decision making process.

Cloud Technology

Machine Learning

AI Technology

Customer Relationship Management (CRM)

One-stop integration of various information relating to customers, more fully support KYC, due diligence, risk assessment and continuous monitoring, and automate the process.

Ongoing Monitoring

The ongoing monitoring system will automatically review the customer database after the daily updates of the database.

Daily Auto Screening

Automated screening and monitoring your clients daily.

Alerts and Notifications

Once a new match is found, a warning message is displayed immediately.

Automatically Save Records

The CDD report will be automatically stored and can be viewed and downloaded online.

CDD Reports and

Auditable Records

Each SN IQ decision is accompanied by a rational proof-of-work file (PDF format) that is securely stored in the system and always available for you to download or print.

Support 60 Languages

Name Searching

The system supports different languages input for screening. These include:

- Traditional Chinese

- Simplified Chinese

- English

- Standard Arabic

- Japanese

- Korean

- German

- Italian

- French

- Portuguese