- CALL:(+852) 3622 1101

- Enquiry: (+852) 3622 1101

- Support: (+852) 6495 2686

SNAML Money Exchange System

Specifically designed for money service operators, combining the exchange remittance system and our specially developed intelligent screening system to simplify the due diligence process during transactions, for money service operators in terms of anti-money laundering (AML) and combating the financing of terrorism (CFT) Provide compliance monitoring and support.

SNAML Money Exchange System

SNAML Money Exchange System is simple and easy to use in operation, providing customers with data, technology and a series of information solutions, easily solving the problems faced by the operation and compliance of the money service industry, and meeting regulatory requirements.

General

Simple function, mostly non-compliant

- Basic currency exchange transaction function

- Basic account management, no ongoing monitoring

- No due diligence function

- No risk management

- No analysis report

- Back up files manually

- Data entry procedure is complicated

SNAML

Comply with the "Guideline on Anti-Money Laundering and Counter-Financing of Terrorism (For Money Service Operators)" stipulated by Hong Kong Customs, providing you with a due diligence solution when combating illegal and terrorist money laundering activities.

- Global currency exchange and remittance function

- Daily exchange rate settings

- Due Diligence Function

*Includes high-risk individuals and entities such as the United Nations Security Council Interdiction List, the US OFAC Sanctions List, the Most Wanted List, and Politically Exposed Persons (PEPs). - Customer Management and On-going Monitoring System

- Customer Risk Assessment

- Electronic version of Hong Kong Customs Transaction Report

- Analysis report

- Secure encrypted cloud server

- Keep History Record

- Backup data automatically

- Easy to use, simple interface

Due Diligence Process

In the process of remittance transactions with customers, the identity of the customer (whether it is the remitter or the payee) must be identified and verified, and the customer’s Hong Kong identity card or valid travel document must be obtained from the customer to verify his identity and address proof documents, and recorded in Skynet's anti-money laundering exchange system conducts due diligence and continuously monitors customers. If the due diligence process cannot be completed, the money service operator (if it has established a business relationship with the customer) must terminate the business relationship with the customer as soon as reasonably practicable and should also assess whether the failure to complete the due diligence process is knowledgeable or not. Suspicion of money laundering/terrorist financing and justification for filing a suspicious transaction report with the Joint Financial Intelligence Unit.

Customers Onboarding

1. The identification documents of both parties of the remittance must be provided

2. Proof of address of both parties of the remittance must be provided

3. Declaration of source of funds

4. Declaration of use of funds

Customer Due Diligence

Leveraging a new generation of automated screening systems, using watchlist screening to increase efficiency, can speed and simplify compliance review of regulatory obligations with regard to Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT).

Risk Assessment

After a detailed analysis of the system, once it is assessed whether the failure to complete the due diligence process is the basis for knowledge or suspicion of money laundering/terrorist financing activities, a suspicious transaction report must be submitted to the Joint Financial Intelligence Unit.

Ongoing Monitoring

The watchlists database is updated every day, and the system will automatically review and monitor the customer base on a regular basis to ensure the safety and stability of the business.

SN Watchlists Database

The watchlist covers global multinational sanctions lists (including the United Nations Security Council sanctions list, the US OFAC sanctions list, etc.), criminal wanted lists, Politically Exposed Persons (PEPs), etc.

Global Sanctions Watchlist

Global Sanctions WatchlistUnited Nations Security Council Consolidated List

Comply with the "Guideline on Anti-Money Laundering and Counter-Financing of Terrorism" stipulated by the HKSAR Government.

Global Sanctions Watchlist

Global Sanctions WatchlistUS Office of Foreign Assets Control (OFAC) Sanctions List

Politically Exposed Persons Watchlist

Politically Exposed Persons WatchlistGlobal Politically Exposed Persons (PEPs)

Criminal Watchlist

Criminal WatchlistICAC Wanted List

Exchange Remittance and Smart Due Diligence

SNAML Money Exchange System is a very important screening solution, providing you with full support in Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT). Built-in global currency exchange and remittance system, the intelligent system conducts compliance review and continuous monitoring based on personal information provided by customers, and provides compliance review reports, providing money service operators with a safe and stable compliance operating environment.

Hong Kong Customs Transaction Report and Analysis Report

The built-in electronic version of customs transaction report automatically calculates the transaction data during the period and submits it in the transaction report. It can be submitted to the customs declaration only by printing and signing, improving operational efficiency. In addition, a series of analysis reports are provided for review.

Hong Kong Customs Transaction Report

Automatically generate customs transaction reports.

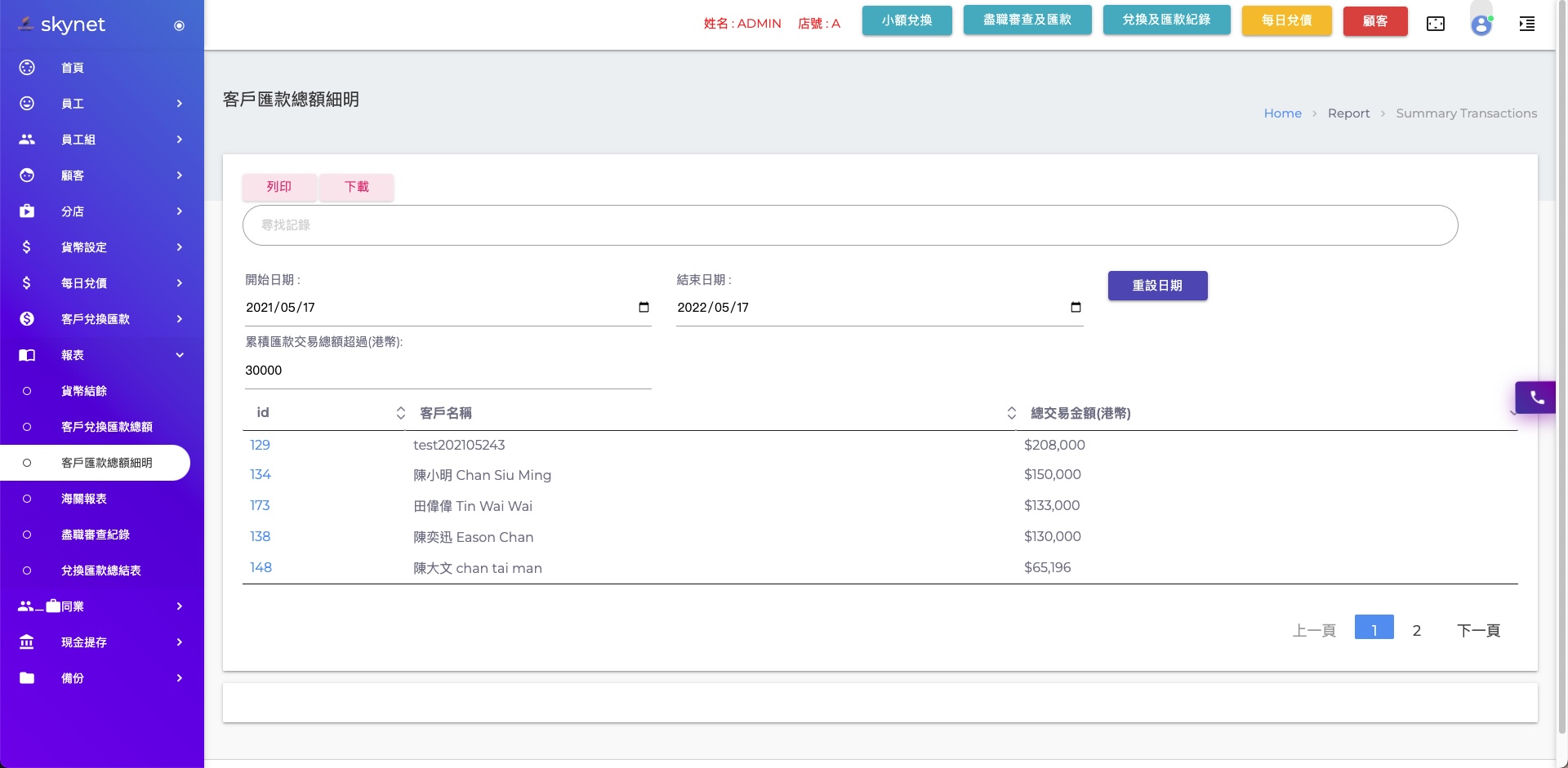

Customer Transaction Analysis Report

Analyze customer transaction status and transaction total.

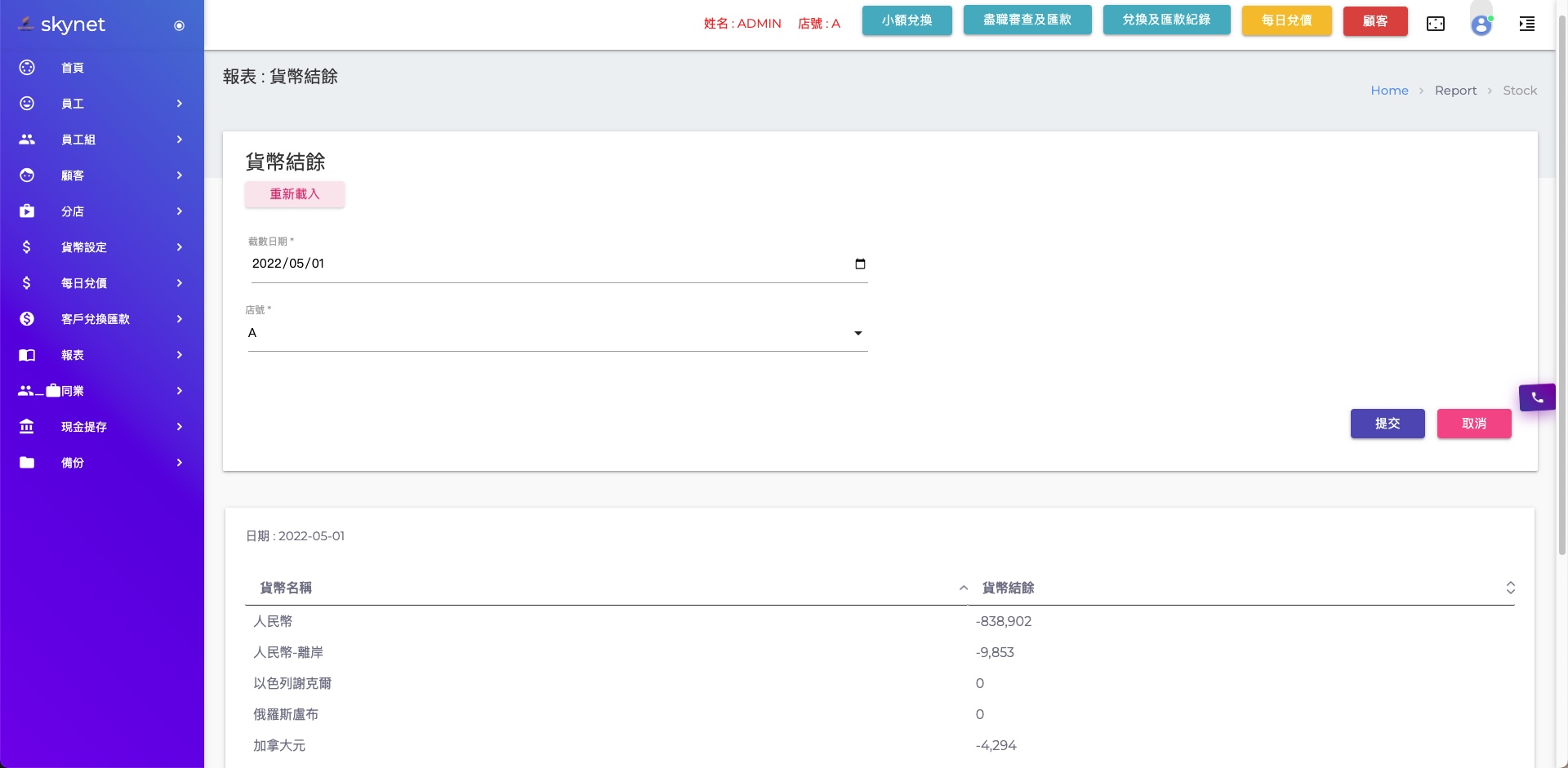

Currency Balance Statement

The report shows the total daily balance in each currency.